However, when you do the math on the G plan, you will realize that even though you would need to pay the Part B deductible, your out of pocket cost is hundreds of dollars lower than the average F Plan premium. I don’t know about you, but I would rather keep my hard earned money in my pocket than donate it to the insurance industry!

Something else to consider is the Medicare Access and CHIP Reauthorization Bill which may affect the F plan in the next few years. Simply put, the F plan may be eliminated and with no new members entering the plan, premiums for those still in the plan would likely increase as the current member’s age and costs rise.

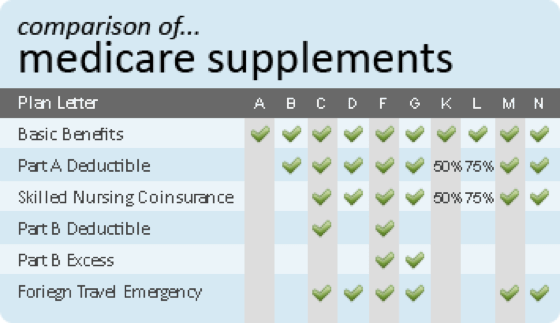

There is one more important point you need to know … ALL G PLANS ARE IDENTICAL! Shocking isn’t it? Especially when you consider the fact that premiums can vary by hundreds of dollars from one provider to another. All the so-called letter plans have been standardized to include the SAME BENEFITS.

Fulmer Insurance Group wants our clients to be able to make informed decisions. Our goal is to provide the information and educate folks so they can make a choice they will be happy with for the long term. Making an uninformed decision can cost you thousands of dollars, so having a broker you can trust is important.

Arnie Fulmer – Licensed Insurance Agent

May I just say what a relief to find somebody who truly knows what they are talking about on the net. You actually realize how to bring a problem to light and make it important. A lot more people should read this and understand this side of your story. I was surprised that you are not more popular since you definitely have the gift. Selene Seward Healy